This iGaming Ontario market performance report covers the third quarter (Q3) of the 2023-24 fiscal year (FY), which ran from October 1 to December 31, 2023. This report includes information on all Operators with gaming websites that had trading activity during that period.1

FY2023-24 Q3 (October 1 to December 31, 2023)

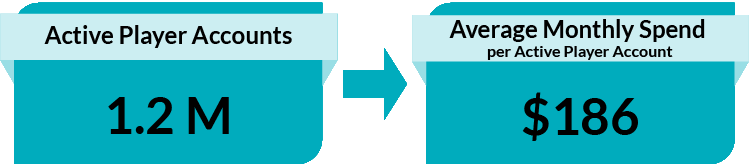

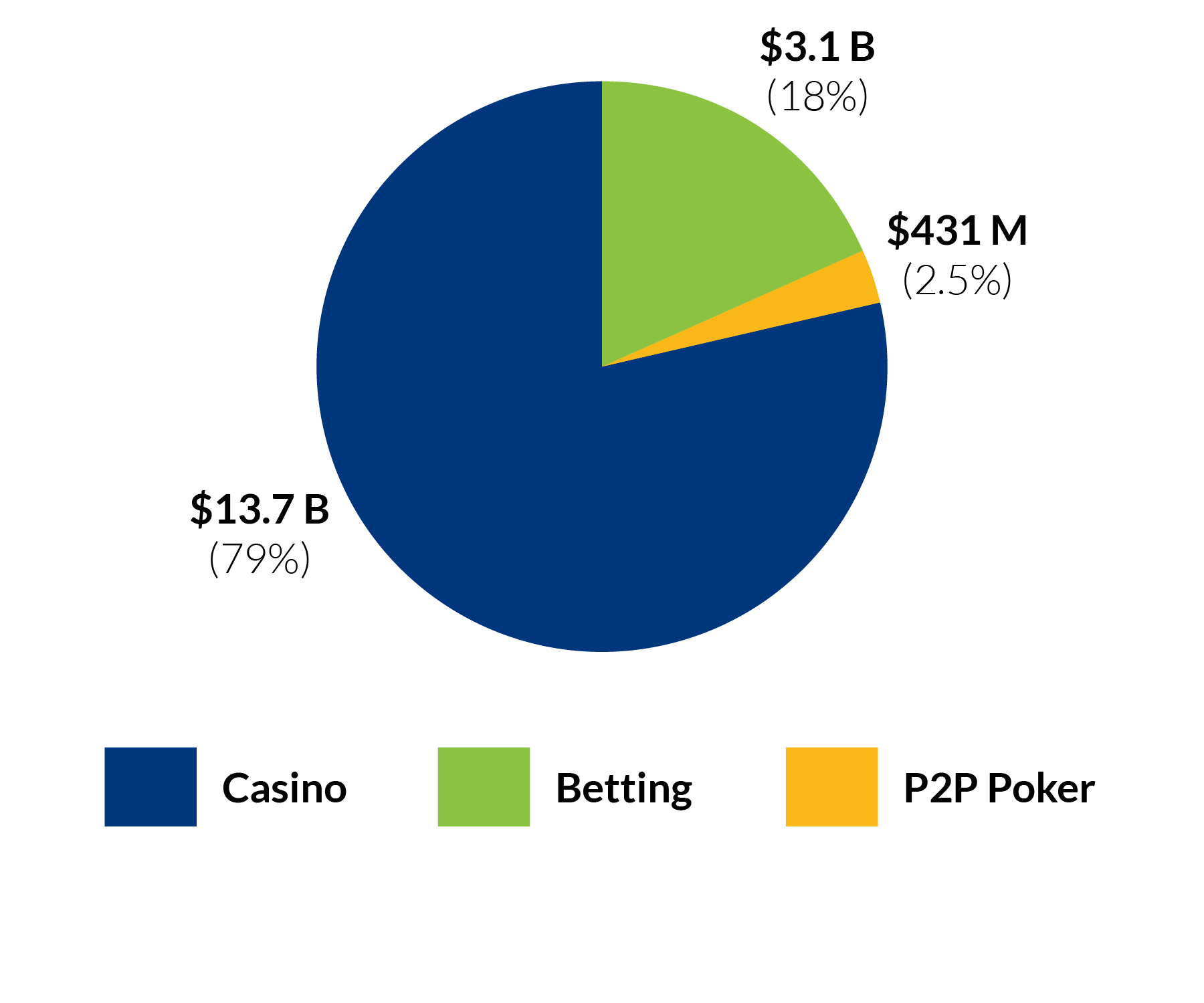

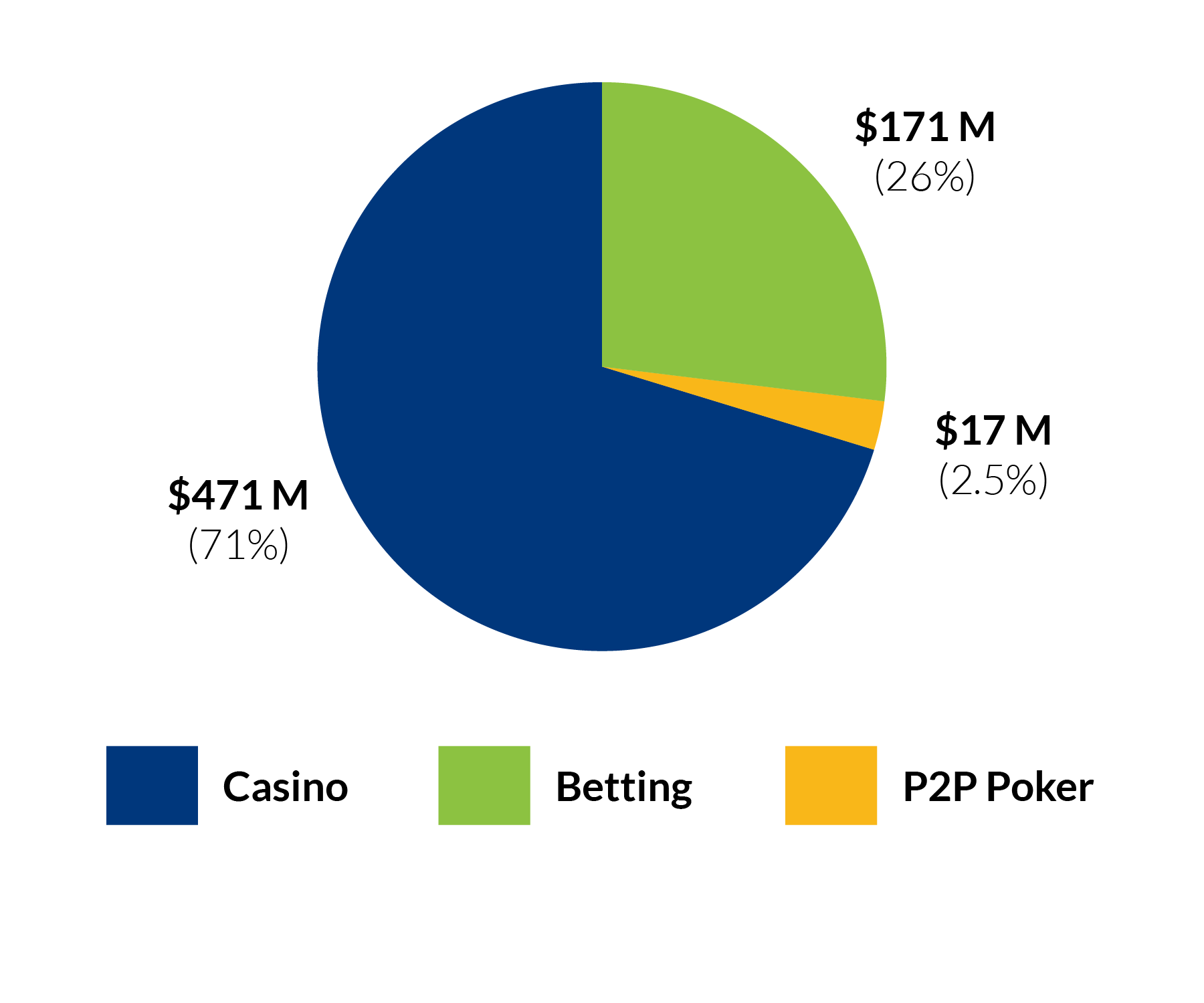

Wagers and Gaming Revenue by Category

(FY2023-24 Q3 - October 1 to December 31, 2023)

Wagers

Gaming Revenue

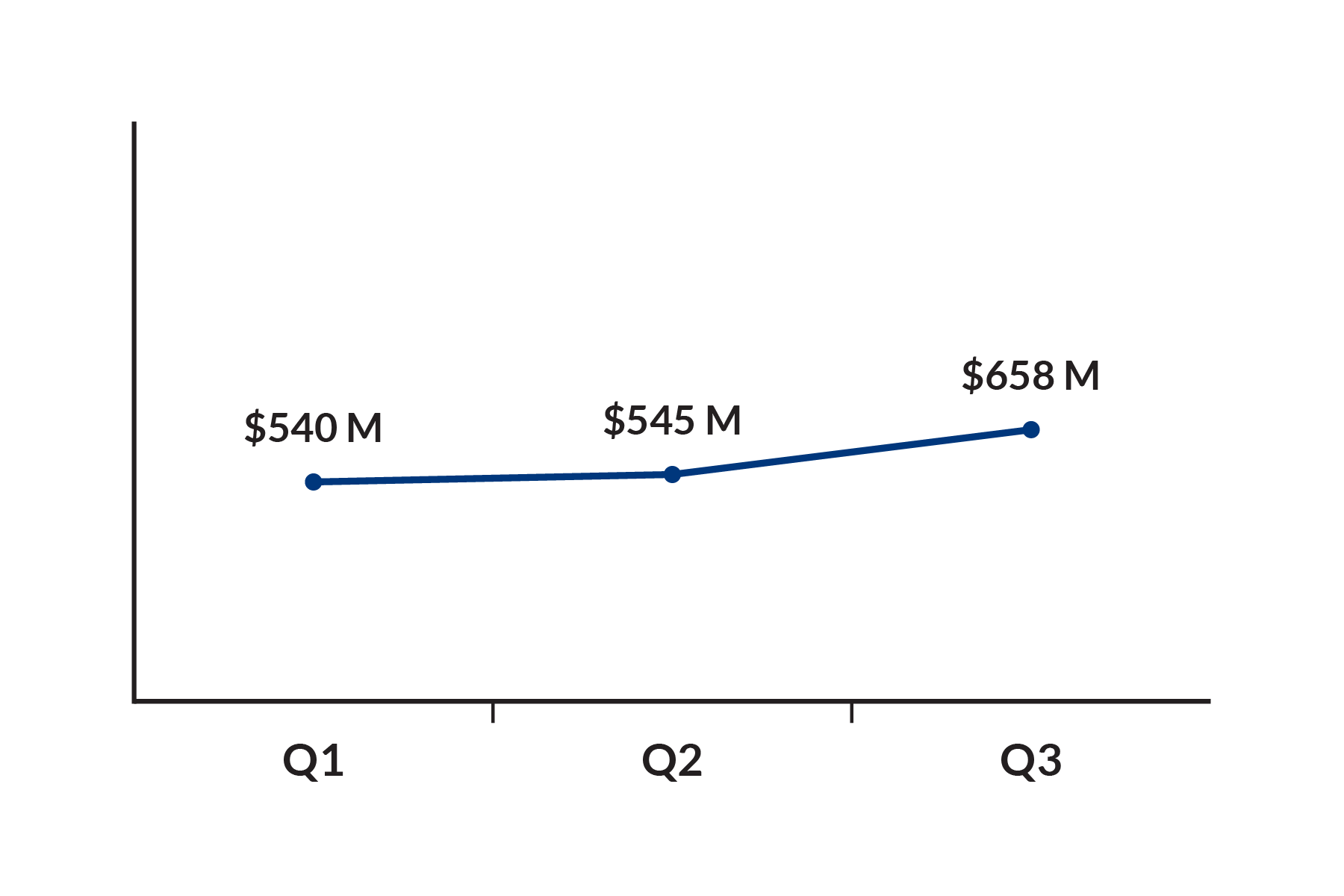

Wagers and Gaming Revenue by Quarter

(FY2023-24 Q3 - October 1 to December 31, 2023)

Wagers

Gaming Revenue

To expand on the data above:

- Total wagers of $17.2 billion, a 21% increase over Q2, does not include promotional wagers (bonuses).

- Total gaming revenue of $658 million shows a 22% increase over Q2. This figure represents total cash wagers, including rake fees, tournament fees, and other fees, across all Operators, minus player winnings derived from cash wagers and does not take into account operating costs or other liabilities.

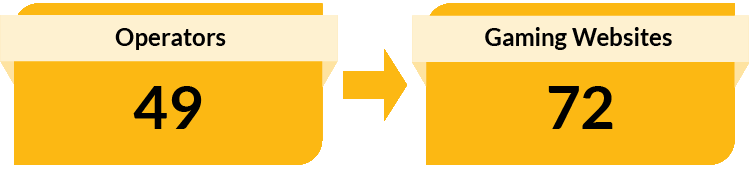

- The count of 49 Operators and 72 gaming websites includes all Operators and gaming websites with trades that occurred in Q3. See the up-to-date list of Operators and gaming sites.

- About 1.2 million player accounts were active during Q3. Active player accounts are accounts with cash and/or promotional wagering activity during the time period and do not represent unique players as individuals may have accounts with multiple Operators.

- The average monthly spend per active player account was $186.2

- Casino games, including slots, live and computer-based table games and peer-to-peer bingo, accounted for nearly $13.7 billion (79%) of total wagers and $471 million (71%) of gaming revenue.

- Betting, including on sports, esports, proposition, and novelty bets, as well as exchange betting, accounted for nearly $3.1 billion (18%) of total wagers and $171 million (25%) of gaming revenue.

- Peer-to-peer (P2P) poker accounted for $431 million (2.5%) of total wagers and $17 million (2.5%) of gaming revenue.

As part of its commitment to sharing aggregate revenue and market insight reports, iGaming Ontario intends to continue releasing, at minimum, a market report on a quarterly basis.

General inquiries: igaming@igamingontario.ca | Media inquiries: igomedia@igamingontario.ca

1The numbers in this report are unaudited and subject to adjustment. Due to rounding, numbers presented in this report may not add up precisely to the totals provided. The Ontario igaming market described in this report includes all eligible games offered by Operators pursuant to an operating agreement with iGaming Ontario from October 1 to December 31, 2023. As such, they do not include OLG’s igaming offering or pari-mutuel wagering on horseracing.

2iGaming Ontario has updated its calculation methodology for this metric to better align with generally accepted standards for measuring monthly active users of technology platforms. Please see the April 17, 2024 restatement of average monthly spend per player account for the updated numbers from this quarter.