2024-2027 Business Plan

This document contains forward-looking statements about iGO's expected or potential future business and financial performance. Forward-looking statements include, but are not limited to, statements about possible operator launches, future revenue and profit guidance, and other statements about future events or conditions. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, the uncertain economic environment; fluctuations in customer demand; and changes in government or regulation. Although such statements are based on Management’s current estimates and expectations and currently available competitive, financial and economic data, forward-looking statements are inherently uncertain. The reader is cautioned that a variety of factors could cause business conditions and results to differ materially from what is contained herein. The information contained in this document is current to December 2023.

Table of Contents

Section 2: Mandate

Vision, Mission and Values

Section 3: Overview of Programs and Activities

Section 4: Environmental Scan and Risks

Section 5: Strategic Directions and Implementation Plan

Growing the Economy

Breaking Down Barriers

Empowering Customers

Building iGO Up

Section 6: Staffing, Human Resources and Compensation Strategy

Section 7: Information Technology (IT) / Electronic Service Delivery (ESD) Plan

Section 8: Initiatives Involving Third Parties

Section 10: Diversity, Inclusion and Environmental, Social and Governance (ESG) Planning

Section 11: Multi-Year Accessibility Plan

Section 12: Three-Year Financial Plan

Section 13: Performance Measures and Targets

List of Tables

Table 1: iGO's Quarterly Market Performance Reports (Q1 and Q2)

Section 1: Executive Summary

In developing this 2024-2027 Business Plan, iGaming Ontario (iGO) considered the age of the organization, market, and our vision to lead the world’s best gaming market. Since our establishment in July 2021, and the launch of the igaming market in April 2022, iGO has been focused on creating a sustainable, healthy, and diverse market that offers player choice, increases player protections, generates sizeable revenues for government, and does so with an operational efficiency and proud culture that acts as a benchmark for a government agency. In just 18 months, Ontario’s igaming market has become the most competitive in North America, with more operators than any other province or state. It also now ranks 6th worldwide by gross gaming revenue,1 a true testament to the work of the agency and the leadership provided by its Board and by its government partners.

As the organization moves forward, this business plan will help guide both its day-to-day and its longer-term strategic decisions. Keeping iGO’s values of fun, respect, empowerment, and excellence top of mind will ensure that iGO delivers on its vision to lead the world’s best gaming market. As seen throughout the business plan, achieving that vision is no simple task. iGO has set out a series of key performance indicators that it will use to measure progress toward that goal as well as a series of internal pillars that ensure consistency and performance across all aspects of the organization. With this objective in mind, iGO will work to Grow the Economy, Break Down Barriers, Empower Customers and Build iGO Up, all while delivering on the mandate given to it by government to achieve the maximum possible return for the government and its citizens. Detailed plans on how iGO will accomplish these tasks are explained below.

1“Online Gambling Market: New Markets Disrupt Global Online Rankings” (Daniel Stone, VIXIO, November 15, 2023) https://www.vixio.com/blog/new-markets-disrupt-global-online-rankings

Section 2: Mandate

iGO's core mandate is to conduct and manage prescribed igaming lottery schemes while promoting responsible gambling. iGO’s mandate is set out in O.Reg 722/21 under the Alcohol and Gaming Commission of Ontario Act, 2019.

iGO is governed by its Board of Directors and executes its mandate to conduct and manage internet gaming in the province when provided through private gaming operators who act as agents on iGO’s behalf.

iGO is committed to supporting the Government of Ontario’s objectives to provide an expanded igaming market that provides consumer choice and enhanced entertainment choices for players; consumer protection to ensure safer and responsible play; support legal market growth and capture revenue; and enable innovation and speed to market by reducing red tape.

VISION, MISSION AND VALUES

To support the agency in successfully delivering its mandate, iGO has developed a vision, mission and value set to guide its operations.

The Vision

To Lead the World’s Best Gaming Market

The Mission

To conduct and manage Ontario’s safe, efficient, and legal world-class igaming market

The Values

Fun

We facilitate new and exciting entertainment choices for players.

Respect

We promote responsible gaming, value diversity, equity and inclusion, and treat one another with respect.

Empowerment

We enable innovation and speed to market by reducing red tape and leveraging private sector expertise.

Section 3: Overview of Programs and Activities

iGO conducts and manages internet gaming in the province when provided through private gaming operators who act as agents on iGO’s behalf. iGO enters into operating agreements with operators who meet rigorous standards of game and operator integrity, fairness, player protection and social responsibility, allowing all players to play with confidence. A share of revenues generated by these commercial relationships are returned to the Government of Ontario to support provincial priorities.

iGO was established on July 6, 2021. Between iGO’s founding and the beginning of the 2024-25 fiscal year, iGO was tasked with creating the conduct and manage framework for the launch of Ontario’s legal, regulated and safe igaming market, which launched on April 4, 2022, and ensuring the orderly operation of the market thereafter. To conduct and manage the market in a short time frame, iGO set a series of operational priorities including ensuring consumer choice and protection, growing the regulated market, building in-house infrastructure and controls, reconciling operator payments and data, establishing anti-money laundering processes, reducing red tape, creating a people-centric organization, and establishing governance and operational capabilities. These priorities guided iGO throughout its first two years of existence.

Fiscal year 2022-23 represents iGO’s first full year of operations, during which customers wagered $35.5 billion with iGO’s operators, resulting in $1.26 billion in gross gaming revenue (GGR) from over 1.6 million player accounts. After operator payments, taxes, and operating expenses (i.e., salaries and benefits), iGO generated a net income for the year of $96.2 million. In addition, iGO also remitted $133.7 million in GST/HST payments to the Federal Government, 37% of which is returned to the province, resulting in a net $84.2 million contribution to the Federal government. When the provincial share of iGO’s GST/HST payments is included, iGO contributed $145.7 million to the province of Ontario’s treasury, which eclipsed iGO’s own mid-year projections by over $15 million.

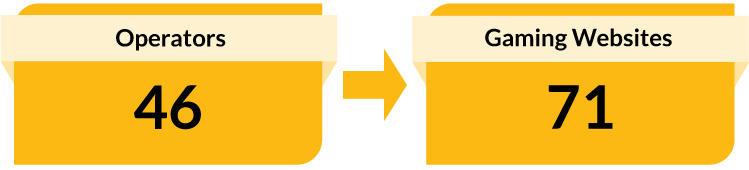

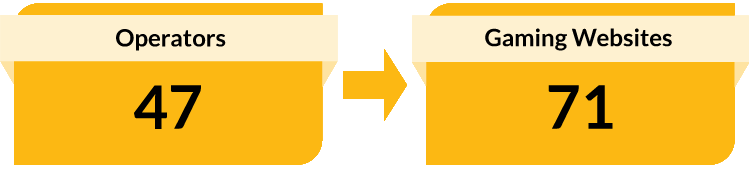

The Ontario market has seen 52 operators with over 70 gaming websites launch, making Ontario’s market the most competitive jurisdiction in North America. These strong results have continued into the 2023-24 fiscal year with unaudited results reporting over $28 billion in wagers and more than $1.08 billion in gross gaming revenue in just the first two quarters of the year. With a continued focus on the priorities below, iGO is committed to helping the market grow even further over the next several years.

Consumer Choice

iGO has created a framework that supports an attractive, open and competitive igaming market to ensure world-class products and user experiences for Ontario consumers. In that work iGO executed over 100 non-disclosure agreements with prospective operators large, small, foreign and domestic to ensure they were able to understand the requirements of the Ontario market before committing resources to launch. The organization also established the game catalogue and game conditions policies which determined what offerings would be legal to provide in the Ontario market as iGO’s agent, which include peer-to-peer poker, sports betting, casino games and novelty betting.

Since launch, iGO has helped 52 operators, offering more than 70 unique websites, go live in Ontario. iGO has also worked closely with external partners like the Alcohol and Gaming Commission of Ontario (AGCO) to help launch peer-to-peer bingo in conjunction with Ontario’s charitable gaming sector, Ontario’s first ever betting exchange, and allowed for Canadian Pari-Mutuel Association (CPMA) regulated pari-mutuel horse racing wagering on an iGO operator site. Each of these initiatives broadens the range of products available to Ontarians, enhance the competitive nature of the market, and weaken the appeal of illegal gaming websites.

Consumer Protection

iGO requires operators to have several consumer protection policies in place that include industry-leading requirements to ensure responsible gambling-focused advertising from operators and accreditation from the Responsible Gambling Council (RG Check). iGO is also planning for a future centralized self-exclusion program.

iGO has developed customer care and dispute resolution policies that set out the requirements and processes operators must implement for players who have serious concerns or complaints related to products, services, or actions of an operator, all to ensure consumers are protected. If iGO finds operators improperly treated customers in any way, the organization’s resolutions to these disputes are binding on operators, thereby ensuring customer protection is paramount.

iGO has also created an anti-money laundering and anti-terrorist financing program framework that includes policies, operational guidance, job aids and training for operators to ensure compliance with federal legislation. In its first year of market operations, iGO reviewed and filed over 26,000 regulatory reports with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). iGO will implement an automated processing system to help improve efficiency and reduce manual processes in the reporting of anti-money laundering reports to FINTRAC.

Regulated Market Growth

iGO continues to work with the government and operators to create market conditions that support economic development, weaken the illegal market, and capture new provincial revenues. This includes regular consultations with operators, enabling innovation and differing market approaches through policy changes and updates, and creating an iGO portal for operators where policies, FAQs and other guidance materials are available. iGO also continues to utilize its account manager model assisted by a small team of finance, anti-money laundering, privacy, legal, information technology (IT) and market insights experts to ensure that all prospective and current operators receive the assistance they need to launch and grow in Ontario.

Reduced Red Tape

A key consideration when creating the rules and policies for the launch of Ontario’s regulated igaming market was to ensure that the market is conducted and managed in manner that is as efficient and commercially attractive as possible while ensuring compliance with applicable law and world-class consumer protections and standards.

iGO continues to foster close relationships with external parties to ensure its requirements and rules are not unnecessarily burdensome to operators and players alike. This approach is paying off with, for example, over 5,000 regulated game offerings available on iGO’s over 70 websites thanks, in part, to a broad game catalogue that enables and welcomes innovation and competition. iGO continues to work with operators to evaluate and accommodate market developments such as potential consolidations, product expansions, and branding changes as iGO’s operators evaluate their long-term approaches to the Ontario market.

People Centric

Given iGO’s recent establishment, the organization has been recruiting and training staff since day one. iGO has focused on doing this in an efficient manner while ensuring the organization builds the foundation of an inclusive, forward-thinking, and engaged workforce. Throughout iGO’s first two years, the organization has grown in a thoughtful manner, aiming to balance immediate priorities with future needs. iGO continues to evaluate its own internal processes to find efficiencies and drive further revenue and improve outcomes.

Governance & Operationalization

iGO has developed a financial and accounting framework to ensure appropriate financial reporting. The igaming model also required iGO to ensure compliance with the complexities of the GST/HST elements of the Excise Tax Act and implement banking relationships with major financial institutions. iGO also had to design and implement a financial system, internal controls, back-of-house processes to enable the execution of operating agreements with operators, and forecasting and analytics tools, while also ensuring these processes worked together to ensure seamless operation once the market launched. Additionally, iGO has successfully completed its first audit that included gaming revenue and is undergoing process improvements to ensure a robust and efficient audit process in the future, including implementing recommendations given to iGO by the Auditor General of Ontario.

iGO is also actively beginning work to improve the way it conducts internal business. This includes the creation of both a data and digital strategy that will allow iGO to make better and more frequent insights about the market as well as automate the manual processes that currently reduce efficiency within the organization, respectively. As part of this work, iGO is also investigating the role of managed services for the organization.

Section 4: Environmental Scan and Risks

The risks affecting iGO’s performance and ability to deliver on its key performance indicators are best categorized into external and internal risks.

External Risks

iGO does not deliver igaming products on its own. Rather, iGO has entered into operating agreements with private gaming operators who operate igaming sites on behalf of iGO in accordance with the requirements established in those agreements. Therefore, a number of external factors facing these operators, and by extension iGO, exist such as: operators’ ability to satisfy iGO’s mandated insurance or banking requirements, talent shortages, cash flow issues, underperformance, mergers and acquisitions, continued competition from the legal and illegal markets, and cybersecurity/privacy incidents.

iGO took a number of steps to help mitigate these risks. These include reviewing and revising initial launch policies and processes to account for real-world considerations and applications such as operator exits, consolidation of gaming sites, and corporate changes such as mergers and acquisitions. iGO has also instituted an account management process post-onboarding to ensure operators are complying with operating agreement obligations and instituted a disaster recovery and an interim incident management protocol.

To help identify additional risks that may exist over the course of the business planning cycle, iGO, with the assistance of a third-party advisor, has begun to develop an Enterprise Risk Management Framework that includes the identification of key risks for which mitigation plans are being created.

In addition, given that iGO is the first agency of its kind in Canada, there are also risks that come with the creation and operation of the organization. In the 2022-23 fiscal year, the Mohawk Council of Kahnawa:ke served a notice of application with the Ontario Superior Court against iGO and the Attorney General of Ontario seeking ‘a declaration that the Ontario government does not “conduct and manage” online lottery as required under s. 207(1)(a) of the Criminal Code’ as well as challenging the legislative and constitutional authority which underpins the regulated internet gaming market in Ontario. The application is expected to be heard in February, 2024.

There are also reputational and financial risks that could materialize from a failure to comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. To address these risks, iGO has established a comprehensive anti-money laundering (AML) policy and program that includes all of the elements prescribed by FINTRAC. iGO monitors operator and player risks and oversees operator compliance with iGO AML requirements. In its first year of market operations, iGO reviewed and filed over 26,000 regulatory reports to FINTRAC.

Gambling is an activity that brings with it inherent risks to players and consequently to iGO as the conductor and manager of igaming. With these risks in mind, iGO established mandatory requirements for operators that complement the AGCO’s regulatory standards. These iGO requirements are: RG Check accreditation for operators, mandatory operator spend on marketing campaigns that focus on responsible gambling messaging, development of a future centralized-self exclusion registry, and the sharing of anonymized player data for the purposes of responsible gambling research. iGO had also created a Key Performance Indicator (KPI) to track player awareness of responsible gambling tools to address this risk head on. iGO surveyed players in Q3 of 2023-24 and found that 63% of players were aware of responsible gambling tools available to them. This figure will serve as the baseline for the KPI moving forward.

Internal Risks

iGO continues to operate in a hybrid work environment with a combination of remote and in-person work arrangements and is committed to a model where employees work in-office a minimum of three days per week once sufficient office space is secured. A hybrid work environment can create internal risks related to employee performance, training, satisfaction, retention, and communication. To help with this hybrid environment, iGO completed a full cloud migration to its own tenant to enable a technological approach that was customizable to iGO’s needs. iGO has also formally transitioned to in-office work a minimum of one day per week. To enable an in-office three days per week model, it is actively evaluating cost effective and modern lease options with the objective of implementation in 2024-25. In the meantime, iGO continues to prioritize in-person events such as town halls, monthly management meetings, and regular touchpoint meetings to ensure proper communications both between and within departments.

iGO has also grown in recent years, bringing on dedicated human resources staff, bolstering the information technology department, and making additional departmental hires where necessary to accommodate faster than expected market growth. This has helped to reduce burnout and increase employee satisfaction.

That said, iGO ensured all hiring decisions were made under an organization-wide effort to prioritize a lean, efficient organization. In the 2022-23 fiscal year, iGO delivered $2.5 million in provincial contribution per full-time equivalent (FTE) – an important measure of our value for taxpayers. That ratio is one of the highest ratios of provincial contribution of any Ontario government agency. iGO is projecting to grow the revenue-to-FTE ratio further over the business planning period in order to deliver maximum value to government and taxpayers.

This was completed while also securing an employee satisfaction rate of 83% for 2022-23 year and an interim rate of 82% for the 2023-24 fiscal year, both higher than iGO’s KPI target of 80% over the business planning period and also among the leaders for any Ontario government agency. This KPI ensures that iGO not only monitors risks related to employee efficiency and effectiveness but also addresses any issues head on.

Section 5: Strategic Directions and Implementation Plan

As previously mentioned, iGO’s vision will be achieved through four pillars of activity: Breaking Down Barriers, Growing the Economy, Empowering Our Customers and Building iGO Up. The strategic directions for iGO are best categorized within each of these pillars.

GROWING THE ECONOMY

Growing the Market

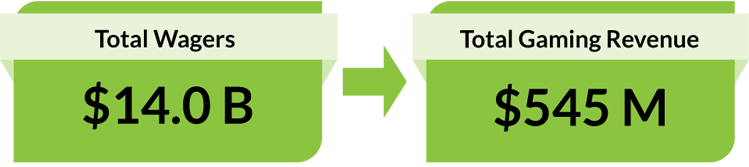

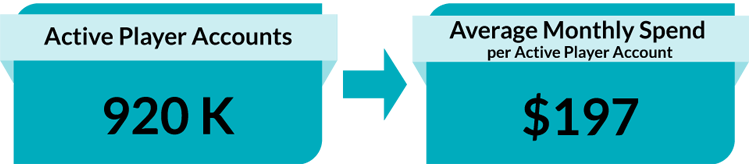

Since market launch on April 4, 2022, iGO has been focused on creating the conditions for a healthy, stable, and competitive market. The organization’s first year saw a rush of operator onboardings, culminating in over 45 operators by year-end. iGO’s operators accepted over $35.5 billion in wagers and made over $1.26 billion in GGR in the first year. Since then, the market has continued to grow with more operators and iGO’s two best quarters coming in the first and second quarter of fiscal year 2023-24. In both quarters, iGO’s operators eclipsed $14 billion in wagers and $540 million in GGR. Therefore, iGO’s focus is shifting from onboarding operators to helping grow the market by expanding the approved suite of product offerings, supporting responsible gambling options, facilitating operator innovation and reducing costs for iGO and operators to sustain a healthy market that promotes player choice and confidence. iGO is projecting to reach $2.1 billion in adjusted GGR in 2023-24, growing to $2.5 billion and $2.6 billion in the next two fiscal years, respectively.

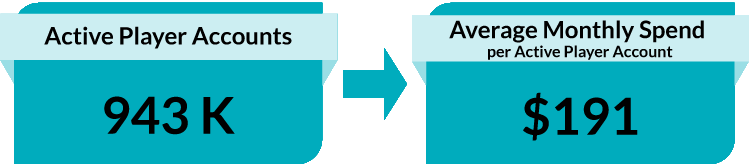

Between April 1 and September 30, 2023, these operators have processed over $28 billion in total wagers from some 943,000 active player accounts, generating approximately $1.085 billion in GGR of which iGO receives approximately 20%. As a result of Ontario’s market growth over the past several months, Vixio, a leading regulatory intelligence company, reported that Ontario (including OLG igaming products) jumped from the world’s 11th largest market in 2022 to the 6th largest market by GGR, surpassing markets like New York, Michigan, and Sweden. Throughout the business planning period, iGO projects the market to continue to grow both on a GGR and total wagers basis.

Operator sites vary in focus, featuring icasino games, sports betting options and peer-to-peer poker. iGO has also recently enabled peer-to-peer bingo offerings, betting exchanges, and – via the CPMA – pari-mutuel horseracing offerings through its operator sites. Peer-to-peer bingo and betting exchange revenue remain nominal, given their recent inclusion, and all horseracing wagers are placed under CPMA supervision and therefore are not included in the above numbers.

Important to iGO is not just the size of the market but the diversity therein. iGO’s operators are a healthy mix of foreign and domestically owned sites, large-, mid- and small-sized operators, and existing Ontario land-based operators. Each operator brings different games, strategies, and product offerings to Ontario’s market, meaning competition, choice, and options for players. Not only are there are over 70 sites to choose from, but over 5,000 regulated game offerings and a large diversity of sports betting markets.

Table 1: iGO's Unaudited Quarterly Market Performance Reports (Q1 and Q2)

FY2023-24 Q1 – April 1 to June 30, 2023

FY2023-24 Q2 – July 1 to September 30, 2023

Notes for Table 1: iGO’s Quarterly Market Performance Reports

- The numbers in Table 1 are unaudited and subject to adjustment.

- Total Wagers does not include promotional wagers (bonuses).

- Total Gaming Revenue is total cash wagers, including rake fees, tournament fees and other fees, across all Operators minus player winnings derived from cash wagers and does not take into account operating costs or other liabilities.

- The count of Operators and gaming websites includes all those with trades that occurred during that period.

- Active player accounts are accounts with cash and/or promotional wagering activity and do not represent unique players as individuals may have accounts with multiple Operators.

- The Ontario igaming market described in these reports includes all eligible games offered by Operators pursuant to an operating agreement with iGO. As such, they do not include OLG’s igaming offering or pari-mutuel wagering on horseracing.

iGO has not only executed operating agreements with 52 operators, but also continued to work with prospective operators who have expressed an interest in joining the Ontario market. This interest is in part due to the large Ontario population and the mature market behaviour operators have already seen in the province. However, it can also be attributed to the province’s competitive revenue share rate, the legalization of icasino products instead of just sports betting, the recent legalization of single-event sports wagering, the lack of land-based ties that are seen in other jurisdictions, and an open competitive process that does not feature an arbitrary cap on the amount of operators in the market.

When these market design factors are combined with an onboarding process that involves personalized account management support, operators are not just invited to join the Ontario market but are welcomed with supportive processes. As the Ontario market matures and stabilizes, iGO is able to shift its focus to value-add activities such as providing valuable market insights to operators and players, reducing administrative inefficiencies to create a more seamless operator experience, and ensuring Ontario is an innovative market leading the world in all aspects of gaming from new product launches to responsible gambling efforts.

Telling Ontario’s Story

Though many companies have joined the market already, competition around the world is ever growing. As more jurisdictions legalize online sports betting and icasino play, the competition for investment dollars, office locations, and product launches grows. To ensure Ontario experiences the maximum benefit from its decision to regulate igaming, iGO continues to encourage operators to launch, invest and grow right here in Ontario.

To do this, iGO must tell Ontario’s positive story to the world both by releasing regular market updates and by making investments in a robust data strategy that will allow for more detailed and comprehensive market insights in the future. This data strategy will take advantage of iGO’s unique position as a central data hub to provide valuable information to the industry regarding player behaviour and trends. This initiative will help operators refine products to meet consumer needs, creating a better playing experience and help to maximize capture of potential revenue that could otherwise be diverted to the illegal market. As a result of these efforts, iGO recently received the Regulatory Initiative of the Year award from Vixio.

iGO has also begun a series of economic development initiatives that includes a commitment to releasing quarterly market updates about the size and strength of Ontario’s igaming market and regular appearances at conferences and panels where operators and suppliers are in attendance. Some of these venues include the Canadian Gaming Summit, G2E Global Gaming Conference, the Commercial Gaming Association of Ontario/Ontario Charitable Gaming Association Joint Conference and the ICE Gaming Conference. That work also includes the release of a key report titled Economic Contribution of Ontario’s Regulated iGaming Market, which shows the scale of investment and spend by iGO operators, supporting over $1.5 billion in GDP, more than $760 million in government revenue, and supporting over 12,000 jobs.2 That report also contained year 5 and 10 projections of the potential economic benefits to Ontario if the market continues to grow. iGO has committed to updating this report with a release early in the 2024-25 fiscal year.

Helping Promote the Legal Market

Though iGO is not a regulator it can play a role in helping the Ontario Government pursue its overall goal of eliminating the illegal igaming market. First, iGO has and will continue to work with operators who follow the standards set by the AGCO and the conditions set out by iGO. The process of helping operators to convert their organization and their players into the legal market is the first and most effective step in combatting the illegal market.

Second, iGO has a role to play in educating stakeholders, including players, of the difference between the new legal market and the illegal market. Awareness efforts such as promotional campaigns, requirements for display of the iGO logo on all advertising and operational sites and helping educate companies such as advertising agencies or payment processors of the benefit of working solely with legal operators, all work in concert to reduce the appeal of illegal market operators. iGO is committed to working with its government partners, including the AGCO, to further weaken the illegal market and make it more difficult for them to operate within Ontario’s borders.

2Economic Contributions of Ontario’s Regulated iGaming Market (Deloitte, June 14, 2023) https://igamingontario.ca/en/deloitte-economic-contribution-ontarios-re…

BREAKING DOWN BARRIERS

Improving the Market

iGO continues to work closely with its operators to ensure compliance with the operating agreement, the Criminal Code of Canada, and other legislative and regulatory obligations. This includes receiving performance security deposits, enforcing operator insurance requirements, collecting and controlling gaming data, collecting gross gaming revenue from operators, and complying with FINTRAC’s anti-money laundering reporting requirements.

To ensure iGO is as efficient and productive as possible, iGO account managers continue to have regular meetings with operators to troubleshoot issues and develop solutions to any emerging obstacles to growth. iGO participates in regular communication with operators through its external consultation platform iGOConnect.ca, ad-hoc conversations and meetings with operators, and through its iGO Operator Roundtable, which meets at minimum semi-annually. These roundtables enable the discussion of emerging issues in the gaming space and the collection of feedback on proposed initiatives and policy changes. These channels of communication assist iGO in refining its policies, the operating agreement, and contemplate future unforeseen issues as well as assist iGO in determining which of its processes can be automated, managed by outside vendors, or run more smoothly to reduce friction and cost.

Pursuing Workable Solutions

To continue to improve and grow the market, iGO is committed to working with government partners to solve remaining regulatory and legislative barriers that may exist. This includes, for example, future work with the Ontario Lottery and Gaming Corporation to support omni-channel player accounts for Ontario’s existing land-based operators that may seek to open igaming sites, and building on the work already done with charitable gaming venues and bingo halls. This work also includes model expansion initiatives such as iGO’s role in enabling pari-mutuel horseracing wagers under CPMA supervision through its sites, and the onboarding of Canada’s first legal betting exchange. As mentioned in iGO’s 2024-2025 Letter of Direction, iGO also stands ready “to support the government’s objectives and policy development activities to drive increased growth and enhanced consumer choice in the igaming framework.” This work could potentially include future initiatives such as working to solve liquidity challenges and helping expand the model to other provinces if requested. These expansions are subject to government policy and regulatory change but, if pursued, iGO stands ready and willing to help.

These new ventures will help ensure Ontario’s gaming market is a world leader and iGO is committed to working with its partners to develop these opportunities.

Gathering Direct Feedback

In addition to the Operator Roundtable process, iGO is also launching a direct player feedback process through player focus groups in the 2023-24 fiscal year and by continuously monitoring player feedback through call centre complaints made to the joint iGO/AGCO customer service centre. Lastly, given iGO’s unique position as a central repository of igaming-related data iGO can derive and share valuable Ontario market insights and observations. iGO is completing both a digital and data strategy to ensure proper data validity and formatting to allow for better market insights.

EMPOWERING CUSTOMERS

Improving the Operator Onboarding Process

iGO has reviewed its onboarding process to reduce unnecessary inputs, eliminate friction in the process, ultimately to reduce the overall time to go live for prospective operators. This work became increasingly important as interest in joining the market accelerated with the passing of the AGCO’s October 31, 2022, deadline requiring the shuttering of operations in the illegal market. By streamlining the onboarding process iGO ensured the legal market could grow while simultaneously reducing the size of the illegal market in Ontario. For more on this work, please refer to the KPI in section 13 regarding a more efficient onboarding process.

Anti-Money Laundering Requirements

As the conduct and manager of igaming in Ontario, iGO must report to FINTRAC when certain occurrences happen in the market such as large withdrawals or suspicious transactions. Given the size of the market, iGO processed over 26,000 reports to FINTRAC in just the first year of operations. Currently, these reports are processed manually, taking up significant time and resources. As a result, iGO is evaluating options that will automate the required anti-money laundering reporting process and reduce the need for manual staff input all while improving efficiency.

Responsible Gambling Tools

Core to iGO’s mandate is the promotion of responsible gambling as a key function of the market. iGO operators must obtain RG Check accreditation from the Responsible Gambling Council within two years of go-live and all launch-day operators have completed or are on track to meet this requirement.

iGO has released its policy to operators that requires them to dedicate a portion of their gross gaming revenue to responsible gambling advertising. Operators will submit compliance reports to iGO next year for the 2023-24 fiscal year.

Additionally, the creation of a centralized self-exclusion registry that enables players to self-exclude from all Ontario regulated igaming websites at once remains a top priority. All told, these measures empower customers to protect themselves from the risks of gambling and play with confidence.

BUILDING IGO UP

Ensuring the Right Employee Complement

iGO’s employees play a critical role in delivering on the agency’s mandate. As the organization moves forward, it has been transitioning to regular operations instead of launching the new market and onboarding operators. This means a change in the focus of employees and potentially the complement. iGO is continually reviewing its structure to ensure the optimal staffing design.

Going Digital First

iGO’s operators provide an online service to Ontario players as iGO’s agents. As a result, almost all their interactions with players – and by extension iGO’s interaction with players – are online. iGO needs to be a digital-first organization to lead the world’s best gaming market. Processing the tens of millions of pieces of gaming data, millions of dollars of GGR payments, and thousands of AML reports per year requires significant digital infrastructure.

iGO recently completed a series of procurements for infrastructure technology systems that have allowed iGO resources to be centrally located on its own tenant. Additionally, iGO is evaluating options to automate AML reporting and risk analysis functions as well as options to better process the millions of pieces of gaming related data for market insight and reporting purposes through a data and digital strategy. Each of these systems may require larger one-time financial investments and, depending on the system, permanent staffing resources to oversee their operations and utilize the data collected. This work will be performed throughout the rest of the 2023-2024 year and beyond.

Building Internal Processes

As iGO is a new organization, many internal processes and policies had to be created for the first time. The Board of Directors was previously seized with approving these policies and assisting in building the foundation of the organization. Now, given many of the needed policies have been established, the Board can transition to one that provides longer-term strategic direction and performs regular evaluations of the organization against its stated objectives. This work has already begun with the Board completing risk identification and mitigation work as well as long-term strategic planning work, both of which have informed the organization’s business planning for 2024-25 and beyond. The Board has also recently established a 360˚evaluation process, with the first evaluation taking place in 2023-24. The evaluation involves both a self-evaluation completed by board members and a senior management evaluation of the board. This evaluation process will contribute to ensuring good governance practices through regular assessment of the Board’s performance, identification of skills gaps, and support needs.

Section 6: Staffing, Human Resources and Compensation Strategy

As a new agency, iGO’s initial focus was on establishing the foundational capabilities to support the growth and rapid evolution of the industry. Staff have worked tirelessly to ensure iGO meets its legislated mandate. iGO is committed to supporting its staff and to promote a culture of diversity, equity and inclusion, ensure strong succession planning and support a healthy life-work balance.

Returning to the Office

As the COVID-19 pandemic ended, iGO had to adapt to the new realities of a hybrid workplace. During iGO’s first year the agency was almost fully remote. In its second year iGO implemented a hybrid workplace approach and is committed to a model where employees work in-office a minimum of three days per week, once sufficient office space is secured. To enable an in-office three days per week model, iGO is actively evaluating cost-effective and modern lease options while fully complying with the Ontario Realty Directive and Interim Measures. iGO’s objective is implementation of a three day per week in-office model in 2024-25.

iGO’s Compensation Strategy

iGO’s compensation strategy, including employee benefits, is in line with the Broader Public Sector expectations and directives. iGO provides a comprehensive benefits package including the following:

- 100% Employer-Paid premiums for Basic Life, Basic AD&D, Health, Dental and Long-term Disability

- Defined Benefits Pension Plan administered by the Ontario Pension Board (for non-union employees) and OP Trust (for unionized staff)

- Short Term Income Protection for permanent staff to a maximum of six months (130 working days) in the calendar year

Bargaining Agent

The bargaining unit for iGO is OPSEU Local 565.

iGO Headcount

iGO’s current staffing allocation totals 76 staff members, not including the Board of Directors, though some positions are still being recruited.

iGO has utilized outside expertise and services where necessary and has also used both contract and temporary staff to ensure the right size and fit for iGO.

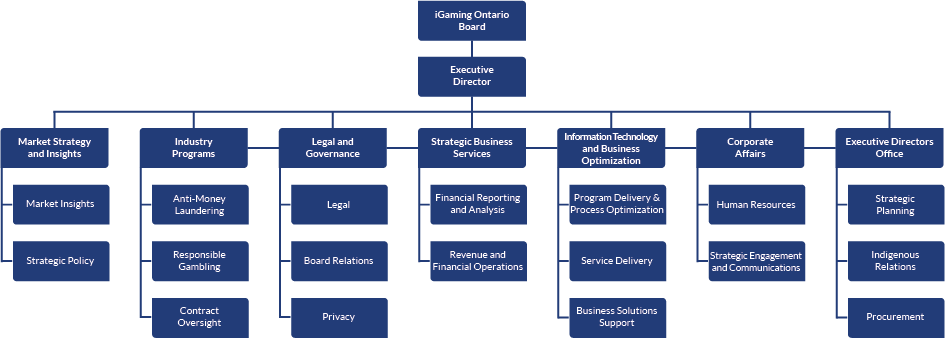

iGO’s current organizational structure is captured below. The organization is separated into 7 business units, each run by management level employees.

Table 2: iGO's Current Organizational Structure:

iGO's Organizational Structure (Accessible view)

- iGaming Ontario Board

- Executive Director

- Market Strategy and Insights

- Market Insights

- Strategic Policy

- Industry Programs

- Anti-Money Laundering

- Responsible Gambling

- Contract Oversight

- Legal and Governance

- Legal

- Board Relations

- Privacy

- Strategic Business Services

- Financial Reporting and Analysis

- Revenue and Financial Operations

- Information Technology and Business Optimization

- Program Delivery & Process Optimization

- Service Delivery

- Business Solutions Support

- Corporate Affairs

- Human Resources

- Strategic Engagement and Communications

- Executive Directors Office

- Strategic Planning

- Indigenous Relations

- Procurement

- Market Strategy and Insights

- Executive Director

Section 7: Information Technology (IT) / Electronic Service Delivery (ESD) Plan

Investment in iGO’s IT infrastructure remains critical to meeting our strategic goals of leading the world’s best gaming market, which includes improving how iGO collects, analyzes, and reports data about its gaming market. Significant progress was achieved in prior fiscal years to realize iGO’s immediate goals of achieving technological self-sufficiency, building a strong IT team and procuring the necessary Managed Detection and Response (MDR) cybersecurity services. The focus for the next three years continues to be automation and continuous efficiencies through technology.

Recognizing the significant importance of the data being collected from operators, iGO will be concentrating on the development of a data governance framework with a focus on data quality and accuracy to reduce time-consuming processing, cleanup, and analysts’ work effort. This will be part of an overall data strategy that is right sized for iGO to reduce complexity and promote adoptability while introducing modern and scalable technologies for data ingest, storage, and analytics while ensuring compliance with all relevant privacy legislation.

Anti-money laundering compliance remains a priority for iGO and is considered integral in the overall data governance and strategy initiatives. We will continue to work on improved operator data ingestion processes and automated analytics to better identify suspicious transactions and high-risk operators and players. In addition, iGO is committed to streamlining FINTRAC reporting to reduce manual work being performed by operators and employees.

The responsible gambling team at iGO, in collaboration with operators and the OLG, continues its initiative to procure and implement a viable and robust province-wide self-exclusion registry for igaming. This is a shared priority for both operators and iGO and will provide another tool to protect vulnerable players.

Section 8: Initiatives Involving Third Parties

iGO’s core operations rely on external third-party agents that provide services to Ontarians on iGO’s behalf. Therefore, most every initiative iGO undertakes involves third parties in some capacity. This means that external engagements with third parties are pivotal to iGO’s ongoing success and igaming market growth.

Building on that work, iGO is in the process of creating a voice of the player process that will allow feedback from Ontario players directly to the agency for the first time. iGO also continues to monitor trends arising from its customer call centre to ensure the voice of the player, positive or negative, is properly understood.

iGO will continue to work with external partners who either work in conjunction with or alongside iGO. This includes the AGCO as the regulator of iGO, the OLG as a fellow conduct and manage entity in Ontario, the Ontario Provincial Police and FINTRAC as it relates to anti-money laundering work, the Responsible Gambling Council as it relates to responsible gaming measures, the Government of Ontario and its Ministries, Indigenous representatives including the Ontario First Nations Limited Partnership (OFNLP), and third-party associations representing the industry and its economic development opportunities such as the Canadian Gaming Association or Ontario-based post-secondary institutions.

Specifically, iGO is pleased to receive direction from the Ministry of the Attorney General on a series of third-party initiatives contained within its 2024-2025 Letter of Direction. These directions include:

- Working with the Ontario Lottery and Gaming Corporation on areas of common interest including responsible gambling and anti-money laundering measures, for which iGO is proceeding on the development of a centralized self-exclusion registry.

- Supporting the government’s policy development activities including a potential role for iGO in expanding Ontario’s regulated igaming market to other provinces.

- Continuing to work with government to support relationships with First Nation partners, including the Ontario First Nations (2008) Limited Partnership, to improve information sharing and continued good faith discussions on revenue sharing opportunities.

- Developing iGO as a leader in market data and consumer insights, for which iGO is actively developing and implementing both a digital and a data strategy to allow for the proper ingest and analysis of hundreds of millions of pieces of gaming related data from operators.

Section 9: Communication Plan

To deliver on its mandate, iGO must clearly and consistently communicate to both internal and external stakeholders. An effective communications strategy is critical in ensuring players can play with confidence that they are playing on a site that is safe as well as better informing Ontarians about the new igaming market and its benefits.

Website

The iGO website is regularly updated with relevant content, including a live list of regulated operators and quarterly market updates regarding iGO’s performance. The site has distinct sections dedicated to players and operators, as well as a new ‘About iGO’ section for corporate reporting and public disclosures.

The player section includes a list of iGO’s approved igaming websites as well as information about responsible gambling tools and the benefits of the legal market. There is also an escalation path for dispute resolution should any players have concerns about their dealings with an operator.

On the operator side of the website there is information explaining how to join Ontario’s legal market, the benefits of doing so, and links to iGOConnect.ca, iGO’s engagement platform for operators and prospective operators.

Social Media

iGO is using social media (X, formerly known as Twitter, LinkedIn, and Instagram) to engage proactively with Ontarians about operators that have joined the legal market, responsible gambling tools, and other important messages such as iGO’s quarterly performance reports. In addition to proactively informing the public of igaming related developments via these channels, iGO also uses these accounts to respond to player issues, as well as for gathering information and viewpoints from players, allowing iGO to include the player voice as an input into its decision-making process.

Media Relations

iGO regularly communicates with members of the media to provide information that helps tell iGO’s story, including the benefits of the legal market, in the most efficient way possible. This includes proactive press releases and responding to media inquiries on an as needed basis.

Section 10: Diversity, Inclusion and Environmental, Social and Governance (ESG) Planning

Diversity and Inclusion

iGO is committed to being a diverse and inclusive workplace for all. iGO, in all its decision making, prioritizes the needs of its current and future potential workforce, including women, racialized communities, Indigenous peoples, LGBTQ2S+ community and persons with disabilities. As iGO grows and creates internal policies, this lens will be applied, ensuring that diversity and inclusion planning is a core tenet from the outset, not a future edit or afterthought.

ESG Approach

iGO has prioritized an ESG approach in its work from its inception. Given iGO’s operators provide a digital service, embedding a digital first philosophy that reduces environmental waste is a core tenet of iGO’s business. On social matters, iGO has created an internal Corporate Social Responsibility committee to spearhead social initiatives such as United Way fundraising campaigns and the creation of volunteer days for staff to dedicate themselves to important community causes. On governance, iGO’s board has created Conflict of Interest policies, committed to the transparent and open publication of data on a regular basis, and embedded practices that meet the highest levels of integrity and accountability to the Government and the people of Ontario.

Section 11: Multi-Year Accessibility Plan

iGO’s accessibility plan and policies are currently under development. Though this process is underway, these policies will be created in accordance with the Integrated Accessibility Standards Regulation (IASR) under the Accessibility for Ontarians with Disabilities Act, 2005 (AODA). iGO will strive to remove barriers for people with disabilities and to create a workplace that is accessible for all. iGO is committed to a future where all external documents created by the organization, including this one, are presented in an accessible format, thereby meeting the Web Content Accessibility Guidelines.

As part of iGO’s shared services agreement with the AGCO, every iGO employee since day one has been trained on the requirements of Ontario’s accessibility laws, including the AODA, IASR and the Ontario Human Rights Code as it pertains to persons with disabilities. This accessibility training has been built into the employee orientation process to ensure that iGO employees and the Board of Directors have a thorough and understanding of accessibility challenges and responses.

Section 12: Three-year Financial Plan

Table 3: iGO's Three-Year Financial Plan

(In Millions $)

FY23-24 Forecast

FY24-25 Budget

FY25-26 Plan

FY26-27 Plan

REVENUE

Adjusted GGR (AGGR)

2,100.9

2,494.0

2,611.6

2,624.4

Less: Operator Revenue Share

1,680.7

1,995.2

2,089.3

2,099.5

iGO Share of AGGR

420.2

498.8

522.3

524.9

Other Income

5.7

4.8

4.8

4.8

Total iGO Net Revenue

425.9

503.6

527.1

529.7

EXPENSES

Total Salaries & Benefits

12.0

14.0

15.0

16.0

Total Other Direct Operating Expenses

7.3

12.9

13.1

12.5

Total Expenses before Stakeholder Payments

19.3

26.9

28.1

28.5

NET INCOME BEFORE STAKEHOLDER PAYMENTS

406.6

476.7

499.0

501.2

HST Expense

220.6

262.8

275.1

276.3

Gaming Revenue Share Financial Agreement Expense

24.0

40.4

47.1

49.3

NET INCOME AFTER STAKEHOLDER PAYMENTS

162.0

173.5

176.8

175.6

Provincial Portion of HST Refunded3

81.6

97.2

101.8

102.2

TOTAL iGO CONTRIBUTION TO PROVINCE

243.6

270.8

278.6

277.8

iGO's 2023-24 fiscal year is expected to far surpass original estimates, with full year adjusted GGR (AGGR) estimated to end the year at $2.1 billion. A combination of a stronger than anticipated sports wagering peak in the early fall, more operators onboarded faster than originally anticipated, and delays in expected recessionary economic events led to this increase. This is the sign of a strong, stable, and competitive gaming market that features more operators than any other jurisdiction, one of the largest per-capita peer-to-peer poker markets in North America, and a top overall igaming market both by revenue and by handle. In fact, by GGR Ontario’s igaming market (including figures from OLG) has reached the 6th largest in the world, ahead of comparable jurisdictions such as Michigan and New York.

Fiscal 2024-25 continues this growth trajectory, with potential inflationary pressures being offset by continued market acceleration. Total fiscal 2024-25 AGGR is expected to reach just under $2.5 billion and Net Income after Stakeholder payments projected to reach just under $174 million.

Throughout the next three years, iGO is planning to carry out various initiatives aligned to each of its core pillars (Breaking Down Barriers, Growing the Economy, Empowering Customers and Building iGO Up). These activities will enable the achievement of its key performance indicators and deliver greater reliability and performance. Accordingly, there is an increase in operating costs during the implementation phase of these initiatives, and then thereafter as various systems come online, notably an automated Anti-Money Laundering solution and the launch of the Centralized Self Exclusion program.

The two most material costs to iGO, reflected in the table above, are its GST/HST payments and payments to Ontario First Nations. GST/HST costs increase in line with the increased revenues and payments to operators, given that this tax obligation is calculated as a percentage of payments to operators, thus directly variable with operator payments. As operator payments increase, so do iGO’s GST/HST costs. However, the net tax generated for the federal government correspondingly increases, all these net new taxation dollars are a result of the new igaming model in Ontario.

Payments to Ontario First Nations increase in fiscal 2024-25 as they are calculated as a percentage of the prior year’s unadjusted GGR, being the 2023-24 fiscal year’s revenues, which were substantially higher than the launch year revenues.

Revenues increase marginally in 2025-26 growing to just under $2.6 billion in 2026-27 fiscal year as stabilization of the market is realized earlier than expected, reflecting a 6% compound average growth from 2023-24 to 2026-27. This level of growth, however, is aligned with iGO’s KPI under the Growing the Economy pillar, which projects 5% average annual growth in this metric over the planning period.

3Assumes 37% of iGO’s HST/GST payment is returned to the Ontario government.

4“Ontario Online Poker Market Outshines the US” by Steve Ruddock (Oct 25, 2023) https://straighttothepoint.substack.com/p/first-impressions

Section 13: Performance Measures and Targets

For the 2023-2024 fiscal year and beyond, iGO identified six key performance indicators (KPIs) to measure the performance of the organization. Given the newness of the organization, some of these key performance indicators still required baselines to be set and benchmarking to be conducted to evaluate progress and conduct future measurement exercises. Below is a summary of the 6 KPIs and the organization’s performance to date in achieving these outcomes. Of note, iGO is either on track to pass or has passed 3 of its 6 KPIs with the other 3 in progress.

The KPIs and iGO’s performance are as follows:

KPI

Description

Performance

1. Achieve 5% annual growth in channelization rate of players to the legal market, reaching 90% within 5 years

In iGO’s first year of market operations the channelization rate (players using a legal site) for players to the legal market, according to the IPSOS study procured by iGO and the AGCO, was 85.3%. This outperforms iGO’s year one target of 70% and puts iGO in a solid position to deliver on its year five target of 90% channelization. The IPSOS definition of channelization in that study was limited to which sites players use without considering how much money or time players spent on these sites. iGO intends to create a more comprehensive definition of channelization as part of its fiscal 2023-24 market sizing research plan.

Passing/Passed

Growing the Economy

2. Achieve 5% annual average growth in net income before stakeholder expenses between 2023-2024 and 2025-2026

The 2022-23 fiscal year serves as a baseline for this KPI. That baseline totals $229.9 million ($96.2 million net income adjusted for stakeholder expenses) from which iGO will look to grow by an annual average of 5% between the 2023-24 fiscal year and the 2025-26 fiscal year. As seen in the projections in section 12 of the business plan, iGO is projecting to surpass this net income target.

In Progress

Empowering Customers

3. Establish baseline of operator evaluation to be used for future KPIs and evaluations

The first operator evaluation framework will be launched in the fourth quarter of fiscal year 2023-24 and will create a baseline for this KPI moving forward. iGO staff and senior leadership regularly engage and consult with operators, iGO has hosted a series of operator roundtables, and initial feedback provided during the market’s one year anniversary indicated positive comments about the organization.

In Progress

4. Establish baseline for iGO player awareness of responsible gambling tools with a goal of increasing the awareness of these tools by 5% year-overyear

iGO surveyed a segment of players in Q3 of 2023-24 to establish a baseline awareness of responsible gambling tools. That baseline is 63% awareness among iGO players. iGO will closely monitor operator compliance for responsible gambling advertisements in the 2023-24 fiscal year and use this program to drive an increase in awareness of responsible gambling tools, helping the organization achieve the 5% year-over-year growth in awareness envisioned in this KPI.

In Progress

Building iGO Up

5. Reduce iGO Touch Time on data and onboarding processes by 20%

iGO has achieved this KPI with touch time for onboarding processes reducing from 10 weeks to eight weeks. Touch Time for data validation in the onboarding process exceeded the target, reduced by 25%, from 20 days to 15 days.

Given that most operators interested in joining the Ontario market did so in 2023-24, iGO expects the number of new operators joining the market to decline dramatically in the coming years. As a result, iGO will be removing this KPI from future business plans and annual reports and commits to replacing it with a KPI that better measures current operational needs and performance.

Passing/Passed

6. Maintain employee satisfaction target of 80%

iGO has set a base target of 80% of employees recommending iGO as a place to work. iGO is completing regular employee satisfaction surveys. In iGO’s inaugural survey in fiscal year 2022-23 iGO obtained an employee engagement score of 83%, thereby exceeding the KPI. Since then, iGO has recorded an employee engagement score of 82% for fiscal year 2023-2024.

Passing/Passed

These KPIs were chosen to ensure an organization-wide view of effectiveness across the seven business units. In addition, they reflect the priorities of iGO management, the iGO Board of Directors and the Government of Ontario seen in the organization’s mandate. Lastly, in addition to these KPIs, iGO has established goals within each of these pillars that contribute to the overall progress in achieving each of these KPIs. These more detailed goals will be tracked internally for the iGO Board of Directors to review to ensure success and achievement of the organization’s KPIs.